People need routines. That’s especially true for expats who are settling into their new life in the United States.

Routines provide the structure for our daily lives: from the time we get up, to our daily meal plans, the number of hours we work each day, and the ways we choose to relax at night.

Of all the components of our daily routines, budget is by far the most important.

As Irish statesman Edmund Burke once wrote, “If we command our wealth, we shall be rich and free. If our wealth commands us, we are poor indeed.”

When you build a budget, you begin to take control of your money and your financial future.

In this brief post, we’ll discuss one popular approach to budgeting and reveal how you can implement it in your daily life.

The 50/30/20 Rule

The 50/30/20 Rule

Budgeting isn’t just about paying your bills on time. It’s about creating a structure that allows you to confidently live within your means, eliminate debt, and reach your savings goals.

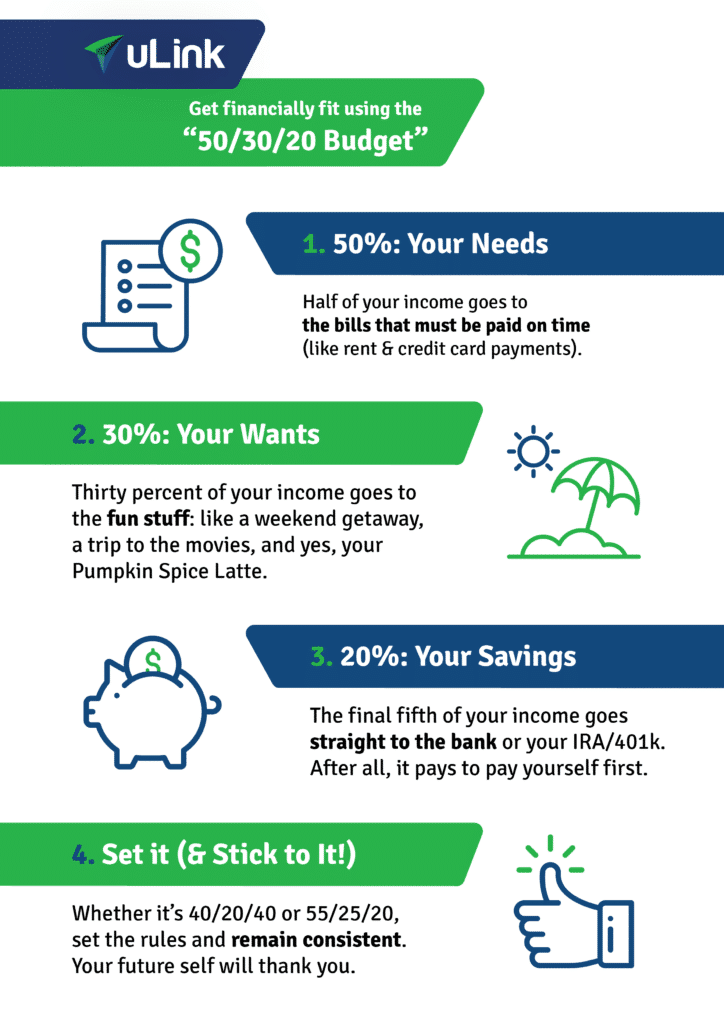

The 50/30/20 rule is designed to help you diversify and strengthen your financial life.

So what is the 50/30/20 rule? As popularized by Senator Elizabeth Warren in her book All Your Worth: The Ultimate Lifetime Money Plan, the 50/30/20 budgeting rule breaks down your finances into three silos: your Needs (50%), your Wants (30%), and your Savings (20%).

Needs: 50% Of Your Income

Your needs are the bills that must be paid on time, like your rent or mortgage payments, car payments, minimum credit card payments, and health care costs.

Your needs are the things you absolutely cannot live without. In following the 50/30/20 rule, half of your after-tax income should go towards covering these expenses.

The 50/30/20 rule is scalable, so if your needs require more than 50% of your income, adjust the formula as needed.

Wants: 30% Of Your Income

Your wants are the non-essential items or experiences that enhance your personal lifestyle.

Like a dessert after dinner, it tastes delicious, but you don’t technically need it.

While your more costly expenses may include a weekend getaway or a gym membership, your wants also include smaller purchases like pizza delivery or a Starbucks latte.

While your wants may have a bit more “gray area” than your needs, try to limit spending on personal luxuries to just 30% of your total monthly income.

Savings: 20% Of Your Income

Whenever you put money in savings, you are actively “paying yourself first.” You are laying the groundwork for reaching long-term financial goals like college savings and retirement. In other words, you’re investing in your future self.

After satisfying your needs and wants, the final 20% of your monthly income should be set aside for your savings. That could mean adding money to an IRA, your 401k, or by investing directly in the stock market. The earlier you invest your money, the faster it will grow.

Alternatively, you can also use part of the allocated 20% to pay down lingering debt. Eliminating high interest debt is one of the smartest ways to pay yourself first and protect your future income.

Finally, you can also consider using part of the 20% to build or add to your emergency fund. Click here to learn more about how you can start an emergency fund.

Identifying (And Managing) Spending Habits

At the end of the day, the 50/30/20 rule provides a framework for you to structure your financial life. While we encourage you to follow its core structure of prioritizing needs, wants, and then savings, take ownership in customizing the exact numbers according to your individual financial profile.

To get started, click here to use a free 50/30/20 budget calculator.

In the words of English philosopher GK Chesterton, “Every act of will is an act of self-limitation. To desire action is to desire limitation.” When you set rules for yourself and your budget, you set yourself free.

So if you choose to spend 55% of your income on needs, 20% on wants, and 25% on savings, go for it! The important thing is that you stick to it and remain consistent.

To get more familiar with your spending habits, check out these popular (and free) budgeting apps:

- Mint: By categorizing all of your credit card expenses, Mint will help break down your spending according to your 50/30/20 budget. You’ll even get notifications whenever you exceed your set limits. Click here to download!

- PocketGuard: While monitoring your budget, PocketGuard will look for great deals to lower your monthly bills (like internet, cable, phone, etc.) Click here to download the app!

With so many small businesses and individuals starting the new year with fear and uncertainty of their finances, taking your money seriously and budgeting is even more important now than ever before.

Getting Started

At uLink, we understand the daily struggles of expats in the United States. You work hard for your money, and you deserve to get it to over to your family fast and safe.

Send money abroad with a great exchange rate and fees starting as low as $0 with uLink.

Plus, after your 1st, 2nd, and 5th transactions, we’ll send you a $10 gift card to use at your favorite retailers right to your email. That’s $30 in gift cards after your first five transactions with uLink.

Miles from home — just moments away with uLink.